Learn how our financial options can help you achieve your dream retirement.

Now that seniors are enjoying longer, healthier lives following their passions, they’re realizing their savings have to go a lot further. That’s why many of them are looking for a smart plan that lets them do what they want to while preparing for the future. As you explore your retirement community choices and learn about the cost of senior living, you may wonder if there’s an option that can give you both.

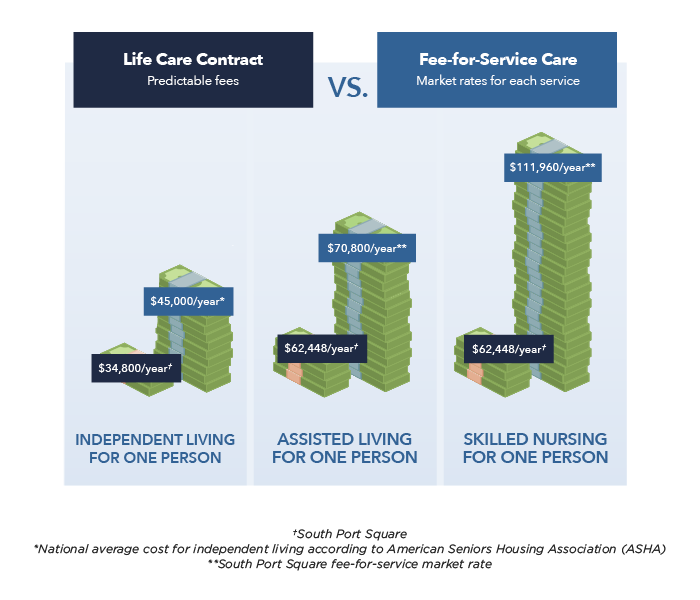

As a Life Plan Community, our independent lifestyle provides you with a variety of services and amenities designed for all the years ahead. Plus, with our Life Care contract, you’ll have peace of mind knowing a full continuum of high-quality care is available at predictable monthly rates right at our community.

Entrance fee and monthly fees

For a one-time entrance fee and ongoing monthly fees, you can make South Port Square your home for life. Entrance fees start at $35,400 and monthly fees start at $2,400 for independent living. To better understand the following fees, we recommend you meet with one of our residency counselors:

Entrance fee

The amount of this fee is based on the type of contract and the size of residence you choose. If you want a larger residence, your entrance fee will be larger too. Your entrance fee covers your residence, but it gives you guaranteed access to any future care you may need at prices well below market rates.

Monthly fee

Your monthly fee covers home maintenance (inside and out), property taxes, utilities, your dining plan, fitness membership, a beautifully maintained campus, and dozens of other services and amenities.

Whether you’re in independent living, assisted living, memory care, skilled nursing, or rehabilitation, your living accommodations, services, and amenities can be adjusted to suit your individual lifestyle and future needs. Plus, we offer contract options that refund a portion of your entrance fee to you or your heirs, for asset and legacy protection.

Flex Your Future

This program lets more seniors embrace the freedom of independent living by tailoring their senior living costs to suit their budget. To customize your entrance fee, select your residence now with less out of pocket, then pay the remainder of your entrance fee on a flexible timeline.

Life Care

Our Life Care contract offers a way to pay for long-term care expenses while saving you tens of thousands of dollars on long-term health care, if ever needed. According to the Department of Health and Human Services, 7 out of 10 adults will need long-term care at some point, for an average of 3 years. Considering the likelihood that you or your spouse will need some level of care, Life Care can be a financial lifesaver!

MoneyGauge calculator.

Take this two-minute assessment, powered by myLifeSite, to learn which South Port Square floor plan is the best financial fit for you.

Tax advantages

Some of our residents use a part of the money from the sale of their home to cover the cost of their independent living entrance fee. The IRS has ruled that portions of both your entrance fee and monthly fee are tax deductible as prepayment of medical expenses. Consult your tax advisor for more information.

Got a question?

Ask us anything you like about our independent living lifestyle, including options for paying for senior living. Simply use the form on this page, or call 941-315-7487.